08 May All About Cash Flow – Woohoo!

Understanding Cash Flow

At its most fundamental level, the term ‘cash flow’ refers specifically to how cash moves in and out of your business. Cash flow is generally measured over a period of time but as a whole affects the business from a daily basis all the way through to a yearly one.

Having cash supports your business to not only meet its goals but to operate on a daily basis. The right amount of money, in the right place at the right time is what keeps your business ticking over. Ask yourself, where is your next dollar coming from and how will you receive it? Where is your next dollar being spent and how will you pay it? How quickly and on what does your business spend its cash?

Cash in and outflows could come from the following sources:

- Accounts receivable – the collection of cash from your clients as payment for your product or service

- Accounts payable – the payment of cash for expenses. Think monthly loan payments, wages, inventory, shareholder payments etc.

- Sale of Plant and Equipment

- Draw down of funding lines

- Payment of dividends

- And so on……

Profit does not equal cash and therefore does not equate to a sound business.

It’s great to be showing profit on your financials, unfortunately it means nothing if you haven’t yet collected the cash.

Being aware of how much cash you need to run your business daily, weekly, monthly and yearly is the first part of the equation. The longer cash stays within your business the easier it is for you to use it for your business. This could be by way of unexpected opportunities to purchase inventory, fund an incentive based bonus for your team or offer a special deal for your customers who pay on time, benefiting both of you.

Having a strong cash balance and flow within your business also gives you the competitive advantage of being able to offer your product or service on your terms that can’t be matched by your cash poor competitors. How nice to be a market leader……..

Cash flow positive is the ideal position – more cash coming in than going out.

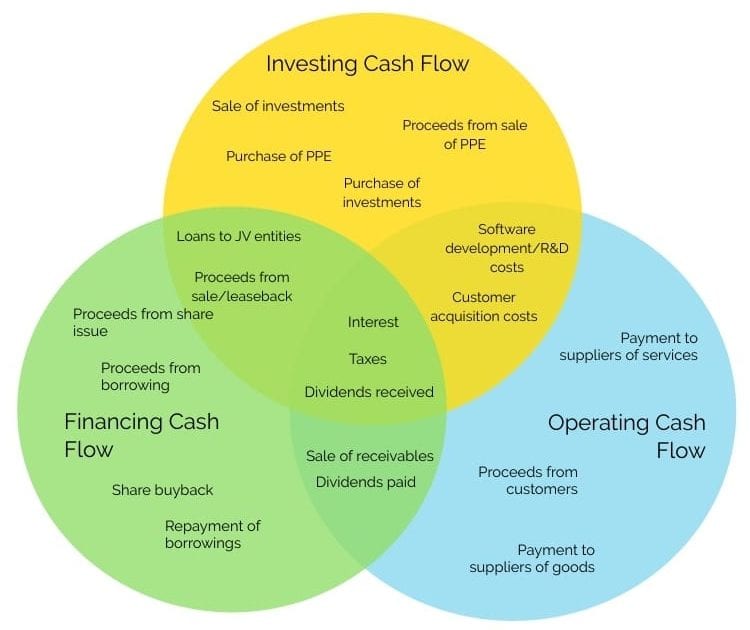

There are three types of cash flow:

- Investing Cash Flow – proceeds and expenses from investments

- Financing Cash Flow – proceeds and expenses from funding

- Operating Cash Flow – proceeds and expenses from business operating activities

I took the opportunity to make a pretty picture that shows various revenue and expense activities and what type of cash flow they are for your reference. You’re welcome :)

Cash is king. Timing is his Queen.

Knowing what actually happens to cash in your business is a game changer. A cash flow statement, prepared and analyzed regularly will help you to identify the movement of cash throughout your business. Knowing and understanding this information allows you to plan for cash peaks and troughs, to budget for purchases and staffing requirements and to take advantage of opportunities as they walk through your door.

You can find free cash flow calculators online – there is a good chance your bank will have one available for you to use on their website. Alternatively, talk to your accountant about setting up a regular cash flow statement for your business. Take the opportunity to discuss the types of questions you need to understand in order to get the most out of your statement. Things like:

- Is the company generating cash, or using it?

- What happens to the cash cycle if your accounts receivable are collected five days late? How about 15 days late? Or 30 days late?

- How is cash impacted if a customer pays a bill?

- What happens to cash if your business purchases inventory?

- What is the effect on cash if you pay a dividend?

- Does the ending cash balance on the cash flow statement equal the cash shown on the balance sheet for the same period? (If not you might have an issue or error to investigate.)

The cash flow statement is used to identify how cash cycles through your business and can help to highlight priorities and weed out the incendiary spending that we sometimes lose track of. Be realistic with your reporting, don’t inflate figures, or recognize revenues or expenses before they actually occur.

How can you control and improve your cash flow?

Anything you can do to control and improve your cash flow is a good thing for your business, here’s a few ideas:

- Push out creditors – adding a few days/weeks to your payments will increase the time the cash can spend in your business. If you do it, don’t get your supplier offside, try to arrange mutually beneficial terms for you both

- Complete credit checks on customers who ask for credit terms – Equifax can help with this

- Reduce debtor days – can you offer a discount in exchange for earlier payment? Reduce your terms from 14 to 7 days for new customers and see how that changes your cash flow, then roll out the new terms to your existing customers

- Use a short-term cash flow loan to help to smooth out the cash cycle – we can help with that

- Sensible use of a credit card can assist with cash timing needs – be aware of using this as a method if you aren’t going to have the cash available to pay it off in full on the due date. There isn’t much point if you are going to have to cop an interest charge.

- Look at leasing or debtor finance. Our sister company Apis Financial can help

- Look at what is and isn’t selling within your business. Have some products or services become obsolete? Refresh your range. Are you carrying expensive stock that could be sold on consignment instead? Talk to your supplier.

- Communicate with your suppliers, build relationships that are mutually beneficial. Often suppliers you have a good relationship with will be open to negotiating terms and will be open to working with you should your business be going through a rough patch

- Increase your prices. Eeeeeeeek! Yep, I said it. Are you undervaluing yourself, your products, your services? Do some research on your competitors, how do you compare?

- Build a cash buffer to see you through slower periods

- Get to know your customers face to face, it’s harder to refuse payment to someone you actually know

What is cash flow lending? Will it work for my business?

Cash flow lending is short-term lending that a business can use for any purpose. This could be covering a temporary shortfall for paying wages, taking advantage of a purchase opportunity for stock or property or investing into plant and equipment.

No particular business benefits more or less from short-term lending. All businesses are susceptible to peaks and troughs and short term lending is available to help smooth out these periods.

Timing is often critical with Cash flow lending, generally it is needed quickly to meet a set pain point or opportunity. If you need help with your cash flow shortfall, let us know, we’re here to help.

If you’d like to do some light reading to better understand cash flow, the CPA website has some great resources along with a course dedicated to managing cash flow!

What are your top tips for improving, managing or monitoring cash flow in your business? Let us know on our Facebook page, we’d love to hear from you.